- Empower your merchants with a commanding technological presence

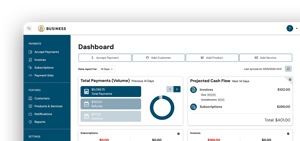

- Gain complete control over your platform and your business

- Modern payments technology all in one place

- Complete certification in a breeze - APP is PCI-DSS compliant

Aurionpro Payments Platform

Low Code, No Code, and Private-Labeled Payments

The Aurionpro Payments Platform is a sophisticated payments infrastructure solution designed for payment facilitators and fintech innovators. Our API-first payments fulfillment platform will span your entire payments needs. Whether you are a merchant acquirer, gateway platform, PayFac, or want to add payments capabilities to your solution - we can help you.

One Platform, Unlimited Options

- Upgrade your legacy software with modern technology

- Easily create third party integrations

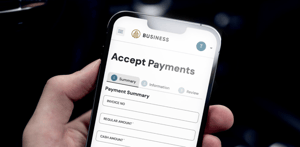

- Intuitive omni-channel payments setup with options for online, mobile, and more

- Take your business to the next step

- Enhance and automate your receivables platform

- Receive payments - customer initiated, QR-code based, and more

- Take advantage of APP’s customizable Plug-and-Play bill payment widget

- Integrate with Quickbooks or your choice of accounting software

Features

.png?width=300&name=Aurionpro_Header_01%20(7).png)

- Quickly onboard and manage partner and reseller networks.

- Offer dedicated, on-demand support to partners and resellers that have been onboarded.

- Streamline the payment process

- Minimize user interactions

- Offer a seamless checkout experience

- Provide customers with a secure online bill payment platform

- Offer a wide variety of payment options

- Send automated reminders to customers

- Seamlessly connect and synchronize with Quickbooks accounting software for efficient financial management

- Automatically transfer data between APF and QuickBooks, reducing manual data entry and errors

- Embed payment functionality to create an instant online footprint

- Take advantage of low-code/no-code integration with other APP components

- Maintain PCI-DSS compliance

- Provide a consistent and seamless payment experience across all channels

- Include web, mobile, payment terminals, and more on your platform

- Offer customers the flexibility to pay using their preferred method and device.

- Provide clear and transparent pricing information to your customers

- Differentiate your pricing based on customer preference and needs

- Create a visually appealing and easy-to-navigate interface

- Customize your branding, payment options, and more

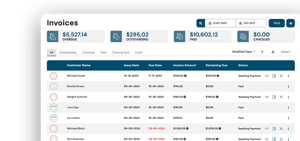

- Reduce errors and eliminate manual effort

- Set up automated payments and invoices

- Include automatic reminders delivered straight to customer inboxes

- Quickly onboard and manage partner and reseller networks.

- Offer dedicated, on-demand support to partners and resellers that have been onboarded.

- Streamline the payment process

- Minimize user interactions

- Offer a seamless checkout experience

- Provide customers with a secure online bill payment platform

- Offer a wide variety of payment options

- Send automated reminders to customers

- Seamlessly connect and synchronize with Quickbooks accounting software for efficient financial management

- Automatically transfer data between APP and QuickBooks, reducing manual data entry and errors

- Embed payment functionality to create an instant online footprint

- Take advantage of low-code/no-code integration with other APP components

- Maintain PCI-DSS compliance

- Provide clear and transparent pricing information to your customers

- Differentiate your pricing based on customer preference and needs

- Reduce errors and eliminate manual effort

- Set up automated payments and invoices

- Include automatic reminders delivered straight to customer inboxes

Empower Your Business, Delight Your Customers

Whether you’re a merchant acquirer, gateway platform, payment facilitator, or looking to integrate cutting-edge payment capabilities, APP is your key to unlocking unprecedented growth and customer satisfaction.

- Full Service Solution

- Customize to Business Requirements

- Control Tech and Payments

- Risk and Compliance

- Payments on the Go

- Bill Payments

- Utility Payments

- Healthcare, Insurance, and Adventure Industries

Supported Payment Modes

- Card Payments

- ACH Payments

- Text-to-Pay or Email-to-Pay

- Embedded Payments

- Hosted Payment Form

- Bank Account Verification

- QR Code Payments

- Mobile App Payments

- Pay-Over-Phone or Virtual Terminal

- Payment APIs

- Subscriptions (Saved/Tokenized Cards)

- Paybot

Why Choose Aurionpro Payment Platform

- Full Product Control

- Modular Customizable Architecture

- Increased Revenue Streams

- Enhanced Brand Experience

- Seamless Software Integration

- Expanded Payment Options

- APP is backed by Aurionpro

Your Solution, Your Way

DIY

Go It Alone

APP

out-of-the-box

Custom APP solution

Bring it together

Your Solution, Your Way

| Licencing Cost | N/A |

| Development Cost | Costly and time-consuming to assemble a skilled development team |

| Time to Market | Lengthy development processes delay market entry |

| PCI DSS Certification | Undergoing extensive processes to achieve PCI DSS compliance can take months |

| Maintenance & Upgrades | Ongoing need for updates and technical maintenance |

| Licencing Cost | ✓ |

| Development Cost | Implementation cost only |

| Time to Market | Quick launch with a proven, ready-to-use platform |

| PCI DSS Certification | Built-in compliance with PCI DSS |

| Maintenance & Upgrades | Platform updates and maintenance provided |

| Licencing Cost | ✓ |

| Development Cost | Implementation and customization |

| Time to Market | Quick launch with a proven, ready-to-use MVP + Platform enhancements |

| PCI DSS Certification | Built-in compliance with PCI DSS with customization that adheres to PCI DSS compliance |

| Maintenance & Upgrades | Platform updates and maintenance provided |

Industry Snapshot

FAQs

Aurionpro Payments Platform is a fully brandable private label payment software. Although APP is not a payment gateway, it integrates smoothly with all major third party payment gateways.

Yes. Our private-label merchant services provide businesses with a fully customizable payment system equipped with multiple payment methods and cutting-edge technologies – all under your brand.

Your merchants can choose the type of integration that is suitable for their unique needs and capabilities:

Host-2-Host integration – allowing merchants to accept payment information on their payment pages using our API first platform.

Plugins – ready-to-use Checkout & Bill-payment widgets & plugins for easy integration of your merchants.

Mobile SDK – iOS and Android SDK for merchants willing to accept payments in their mobile applications.

Integrating a private-label platform depends on the client’s payment needs and customizations. The typical timeline for out of the box, full service implementation varies between 3-6 months including PCI Audit.

However, the setup time is calculated on a case-by-case basis.

Of course. Depending on the complexity of the documents and the pace of contact with the technical team of the relevant payment system, the integration will take 4 to 6 weeks.

Not directly, but let us know if your needs and we can help! We have many partners that specialize in acquiring/payment processing services. We’ll refer you and help facilitate the conversation.

Private label payment gateways offer various branding options, such as customizing payment pages, using custom URLs, and tailoring customer communication. These options ensure businesses can deliver a cohesive and personalized payment experience to their customers.

Pay-Over-Phone or Virtual Terminal, Text-to-Pay/ Email-to-Pay, Embedded Payments, Hosted Payment Form, QR code-based payments, Swipe to Pay, Mobile App, Payment APIs, Subscriptions – Saved/ Tokenized cards, Paybot.

Yes. APP is PCI DSS compliant. Our team also provides necessary PCI DSS certification support.

Yes. APP has an in-built bank account verification module that allows you to verify the customer’s bank account while setting up subscriptions.

Yes. APP is a modular platform designed to plug-in with 3rd party software that offers different communication modes like APIs or other offline modes.

Yes. We constantly upgrade APP to keep up with latest industry trends and security requirements.